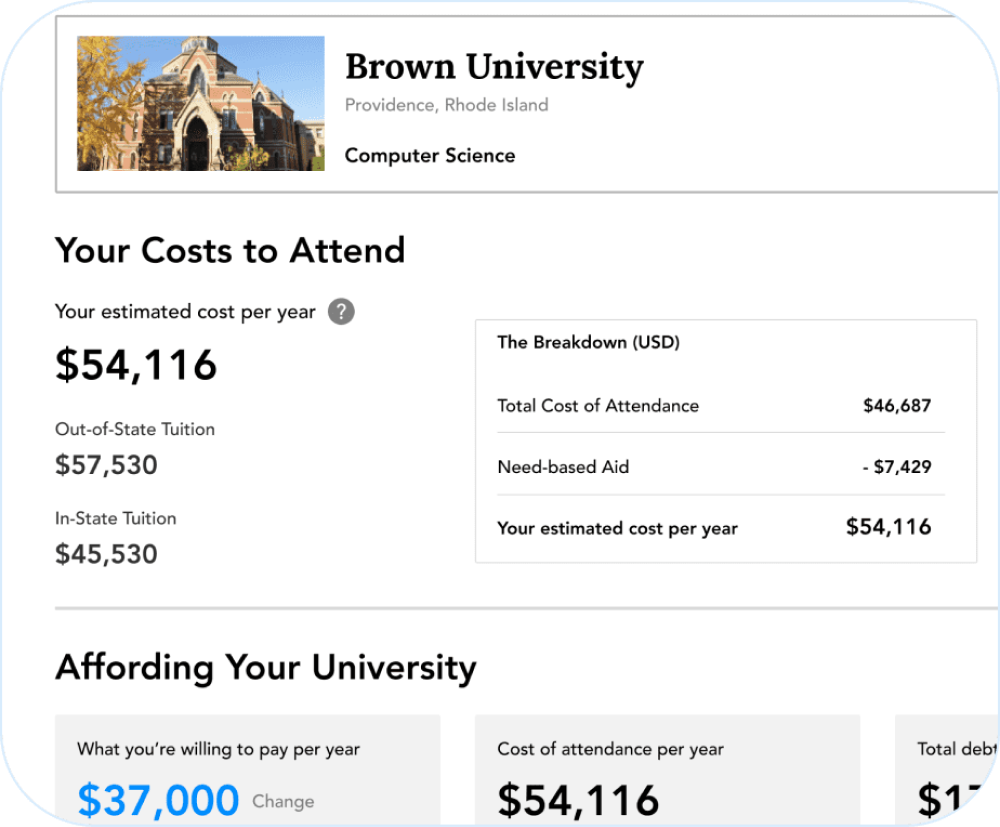

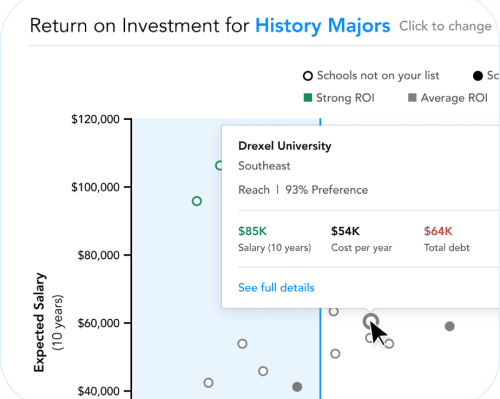

Understand the True Cost of College—and How to Pay for It

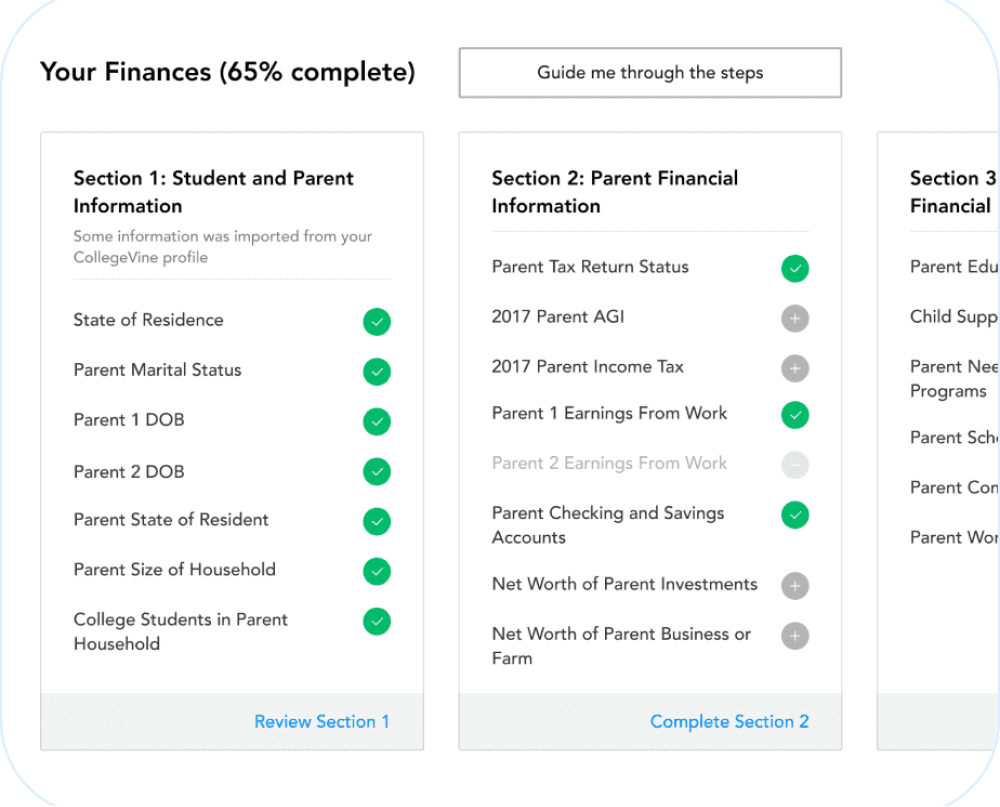

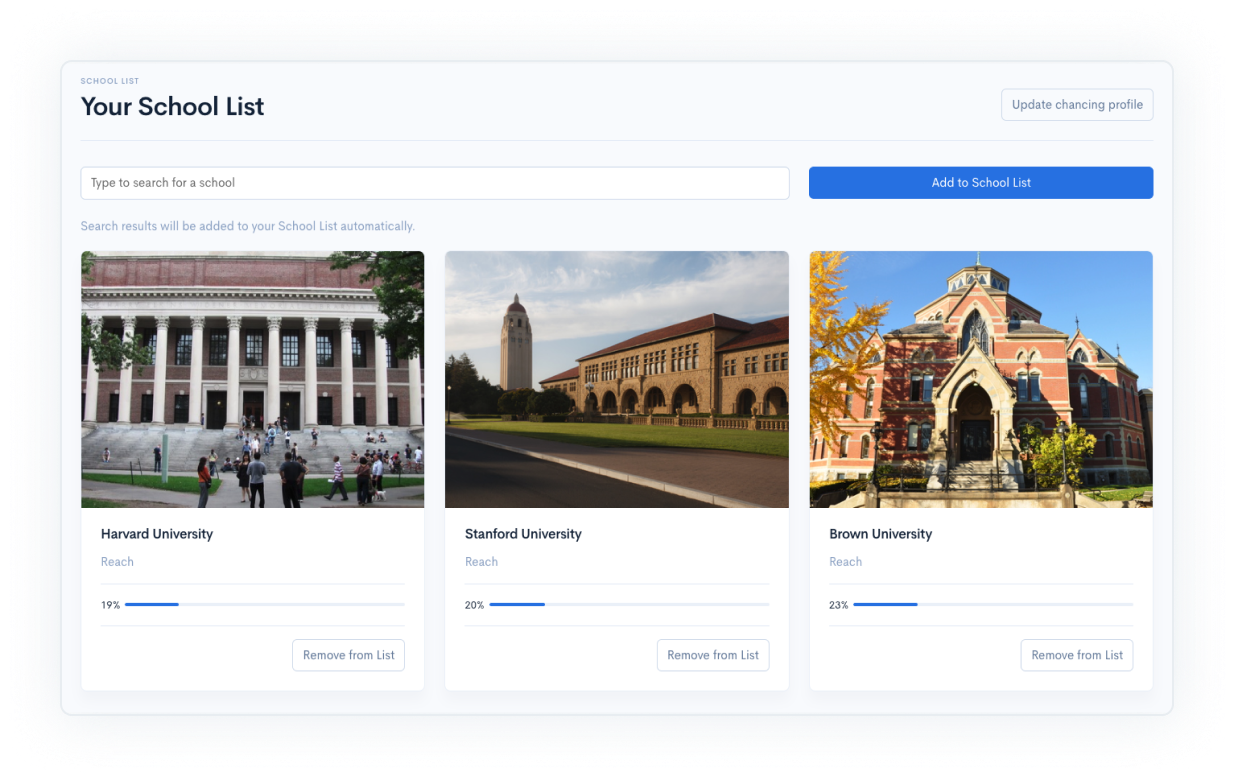

Paying for college can be a confusing and challenging road to navigate. We help families understand how to maximize financial aid and fully understand your college investment.